Hugo Brossard

Financial Director

Our holding company provides equity investments ranging from €2 to €20 million to companies with sales of between €5 and €100 million. Our investments support capital increases, leveraged buyouts (LBOs), special situations and restructuring.

“We tailor our approach to each shareholder’s situation, creating customized deals. Thanks to our entrepreneurial culture and extensive turnaround experience, our decision-making processes are extremely responsive. ”

In collaboration with management, we support

Simultaneously, we annually allocate over €30 million to buyout funds created by entrepreneurs in Europe and the USA. These first-time funds are always sector specialists.

“We connect our managers with key contacts in several countries across Europe and USA to accelerate their international development.”

Since 1998, we are proud to have supported more than twenty ambitious entrepreneurs in their growth plans.

Since 1998, we have completed 23 transactions and 9 acquisitions, and brought together more than 26 co-investors, entrepreneurs, family offices and institutional investors.

Since 1998, we have allocated over €150 million to 18 emerging and sector funds across Europe, Canada, and the USA.

Our team is dedicated to supporting our investments without charging management fees.

In today’s highly competitive markets, our role is to arbitrate priorities and optimize strategic, financial and operational issues.

Strategic Issues, implementation and integration of external growth (build-up), organisational decisions for international expansion, development of new product and service lines, pricing strategies, digitalisation of customer relations, marketing plans, etc.

Financial Issues, profit-sharing for management teams, securing new financing (LBO, capex, WCR (working capital), revolving, subsidies, leasing), recapitalisations (OBO), monthly closings and reporting, data analysis, organisational accounting, internal controls, and cash flow optimisation, etc.

Operational Issues, data anlysis, organisational structure, process implementation, cost management, supply chain, purchasing, ERP selection and implementation, etc.

“Our values are responsibility, agility and curiosity. We work in an agile manner, using an iterative and collaborative approach that places the customer at the heart of every project, encouraging creativity, empathy, and adaptability.”

Adrien Lévy : Deloitte, Arts et Biens

Benjamin Lévy : Arthur Andersen, Arts Et Biens, Abacus

Félix Lévy : Faurecia, Airbum

François Lévy : Safat, Colroy, Devanlay, Sai, Dolisos, Arts Et Biens, Haras De Vulsain

Sarah-Louise Lévy : Ritz Paris, Cheval Blanc, Alléno

Alain Roubach : Love Burger, Leon De Bruxelles, Lazard, Banque Du Louvre, PRE-IPO Invest

Fabien Sultan : Business lawyer, Atria, Naxicap, Committed Advisors

Arts et Biens is a family-owned investment company founded by Pierre Lévy in 1956. Its longstanding presence, extensive experience and financial strength provide security and peace of mind for entrepreneurs.

Arts et Biens remains family-owned. Assets under management total €130m. Since 2006, when the strategy was refocused on buyouts, NAV has increased by 12% per year, from €21m to €130m, with dividends reinvested.

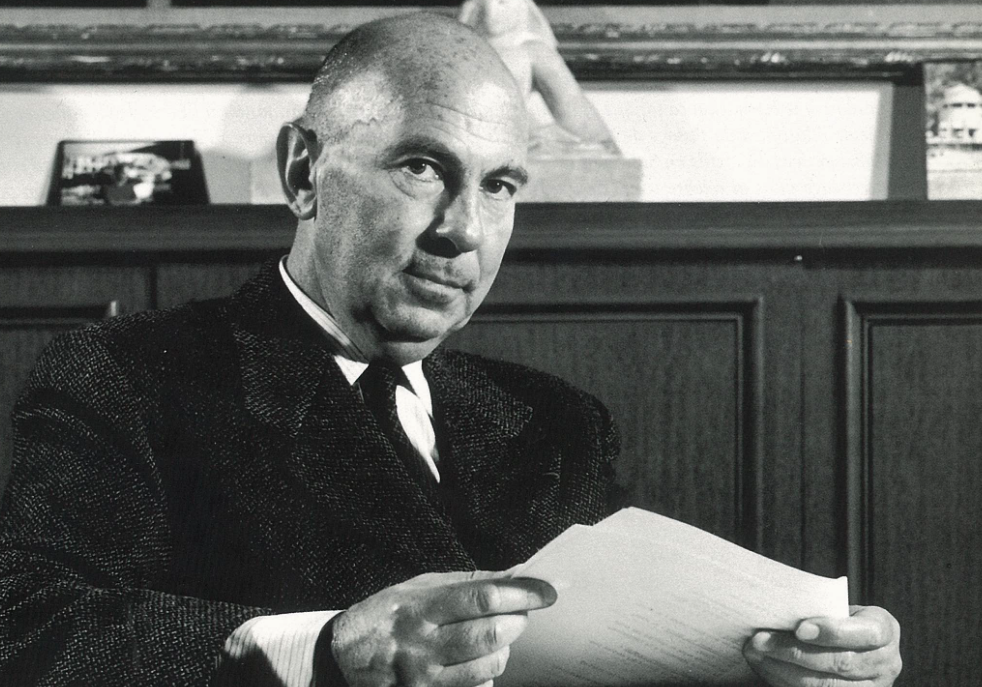

Pierre Lévy

Founder of Arts et Biens